Founders are more cautious in their financial forecasts for investors than non-founders

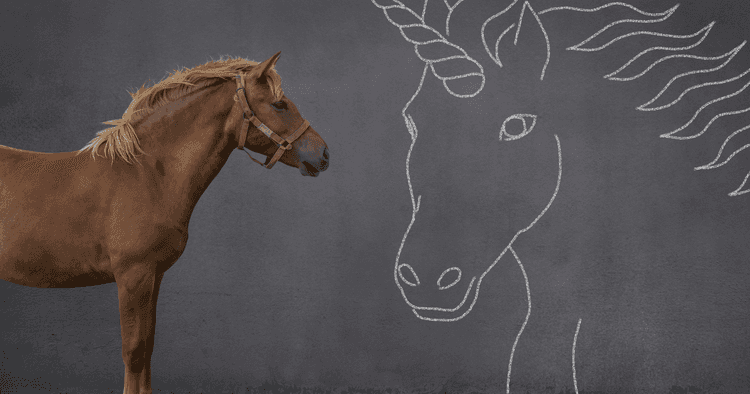

Entrepreneurs are not the over-optimistic dreamers that investors often believe them to be

By Veroniek Collewaert

Professor of Entrepreneurship

- In the forecasts they have to report to their investors, entrepreneurs overestimate their revenues for the following year by an average of 22%.

- Founders are consciously more cautious than non-founders. Founders have a closer relationship with their business and are more concerned about the possible negative consequences of their overestimations in the long run. They are still optimistic towards investors, but less so than non-founders (average overestimation of 15% as opposed to 27%).

- Investors who apply a standard discount to revenue forecasts therefore run the risk of being quite inaccurate themselves.

- On the positive side, investors seem to be good at assessing over-optimism, in the sense that over-optimism does not help entrepreneurs to secure further funding and those who are most optimistic find themselves being labelled as risky businesses.

These are the most important conclusions of a new study conducted by Professor Veroniek Collewaert (Vlerick Business School and KU Leuven), Professor Tom Vanacker (Ghent University and University of Exeter, UK), Professor Frederik Anseel (UNSW Business School, Australia), and PhD student Dries Bourgois (KU Leuven). They studied the use of entrepreneurs’ revenue forecasts as a tactic to impress investors. This involves post-investment reporting, i.e. after the first funding round. The insights of this study are interesting for both entrepreneurs and investors.

The research is based on the analysis of two datasets of annual revenue forecasts from entrepreneurs, originating from two large venture capitalists that have portfolio companies in Belgium, the Netherlands, France, Germany and Switzerland. As a further supplement to this analysis, two experiments were conducted among entrepreneurs.

Naive and optimistic? Or strategic and rational?

Every entrepreneur who wants to grow their business faces the challenge of attracting financial resources. It is hardly uncommon for them to overestimate their expected revenues in the hope of getting investors on board. However, this study found that this tactic is often used even after the initial funding round. Admittedly, it is done in a more considered and strategic manner. An investment is not a one-off transaction, after all, but the start of a long-term relationship.

Veroniek Collewaert, Professor of Entrepreneurship at Vlerick Business School and KU Leuven: “It's no secret that investors love ambitious goals. At the end of the journey, they still want to haul in attractive returns, of course. Entrepreneurs know that, so they are tempted to present things in a more positive light to keep their investors on board. But there's a fine line between presenting yourself as better than you are and lying. A lack of accuracy leads to a breach of trust and loss of credibility. So entrepreneurs need to play this game extremely carefully. We also discovered that CEOs who are the founder of their company take a different approach to this game than non-founders."

Founders are not naive optimists

Entrepreneurs are often described as irrational optimists who are convinced that their business plan is going to conquer the world. It is true that in their reports to investors entrepreneurs overestimate their future revenues by an average of 22%. However, founders turn out to be considerably more cautious than non-founders, only overestimating by 15% rather than 27%.

Frederik Anseel, Professor of Management at UNSW: "At the root of this discrepancy are different tactical considerations. CEOs who are recruited from elsewhere tend to focus more on their career in the short term, and so they are less concerned with the possible effect of an optimistic estimation on the long-term relationship with the investor. For founders, their company is often their life's work. They play the game more cautiously and try to be positive enough to keep investors on board in the long term, but without harming their credibility or competence. In other words, founders are not the naive dreamers they are often thought to be. They carefully analyse the pros and cons of the social and financial impact of overestimating their future revenues."

Make a distinction

This difference between founders and non-founders is also important for investors.

Tom Vanacker, Professor of Corporate Finance at Ghent University and the University of Exeter: "Since investors also perceive entrepreneurs as extremely over-optimistic, there is a kind of unwritten law that says investors should reduce the revenue predicted by entrepreneurs by a certain percentage. Guy Kawasaki, an American investor, goes as far as to recommend a 90% reduction for all entrepreneurs. Our study has now shown that (1) that percentage is excessive, and (2) that an equal reduction for everyone is not appropriate. It would be better for investors to take the newly observed differences between founders and non-founders into account."

Over-optimism is penalised

Finally, the research has also shown that investors have a sixth sense about excessively positive revenue predictions. Once the initial round of investment is over, entrepreneurs who play too fast and loose no longer get away with it quite so easily. Investors flag them as risky businesses and their reputations suffer. So over-optimism certainly does not help to persuade investors to participate in subsequent funding rounds.

Get in touch!

Veroniek Collewaert

Professor of Entrepreneurship/Partner