Continuing to live well or mere survival?

Improving your investment skills makes all the difference

By Jan Longeval

Adjunct Professor of Finance

An interview with Jan Longeval, a lecturer at Vlerick in the Masters in Financial Management programme and the Asset Management consortium programme, about his book God dobbelt niet op de beurs (which translates as ‘God does not play dice on the stock market’)

What prompted you to write this book?

Jan Longeval: “I noticed that average investors face a substantial problem with regard to their investment performance, and I wanted to propose a solution. You see, I’ve been active in asset management for thirty years now and have been lecturing on this subject for twenty. Academic research and my own research both force you to face the same shocking facts: at least 99% of all private investors and more than 85% of all actively managed investment funds aiming to beat the stock market perform more poorly than the stock market after deduction of the costs.

Why is this so? Because of the costs, and also due to a lack of knowledge or a faulty perception of the rules by which financial markets operate. In my book, I dare to put a finger on the problem, but I do provide a sufficiently nuanced perspective at the same time. I think it’s important to mention that a large group of professional investors are doing an excellent job, for example. They aren’t trying to beat the market: instead they create added value by optimising investment portfolios held by insurance companies, for example, within a strict statutory framework.

The desire to share my knowledge and experience with a wider audience prompted me to write this book. Still, there is an even more important reason for doing so, which you will understand when you read the subtitle: ‘Improving your investment skills for a better life’. The aging population puts a gigantic burden on the government and statutory pensions are coming under increasing pressure. It is also highly likely that the interest rate will drop to -4 or even -5%. You will find the reason for this in my book. As a result, people are becoming more dependent than ever before on the performance of their investments. If you want to retain your present standard of living, improving your investment skills is a must. The difference between continuing to live well and mere survival depends, in other words, on how good you are at investing.”

Who should read this book and why?

Jan Longeval: “Anyone who has an investment portfolio, regardless of whether they manage it themselves or entrust it to professionals, and everyone who is interested in the operation and “secrets” of the financial markets. The way the financial markets operate and the mechanisms of the stock market are explained here in plain language. I have also made sure that my explanations are not overly technical. You won’t find any mathematical formulas in the book, for example, and a great deal of effort went into turning it into a book that is pleasant to read. I was very pleased to receive feedback along these lines from the first readers. Pierre Huylenbroeck, editor of Mister Market Magazine, describe my book as follows: ‘Jan Longeval is both a marvellous storyteller and one of this country’s greatest experts in the field of investments and the stock market. This book will teach you a lot, and you will really enjoy it as well.’

Besides explaining the rules of the game, the book offers tangible, practical ways of achieving a better return on investment. Pascal Paepen, investment expert and lecturer at KU Leuven, Thomas More and CVO HIK, quips: ‘Warning. The engaging style of this book will lead to higher returns, even among experienced investors. First-timers are at risk of being bitten by the stock market bug. Highly recommended!’

Last but not least, I also thought I should add another dimension to the book. Throughout the book, and particularly in the epilogue, I link my knowledge about how the economy and the stock market work to insights from other scientific disciplines such as psychology, neurology, philosophy, physics and mathematics. This is because I have discovered fascinating analogies between how the stock market works and various natural phenomena over the years. These insights can help you shape your perception of the world, but they also help the reader understand how to play the stock market. Take the relationships between fluctuations on the stock market, the way an ant colony operates, how dust particles dance in a ray of sunlight, turbulence in the atmosphere, and so on. Landslides, earthquakes and stock market crashes have more in common than you would think at first glance. This is why this book is also relevant for people who want to understand how things work in our world.”

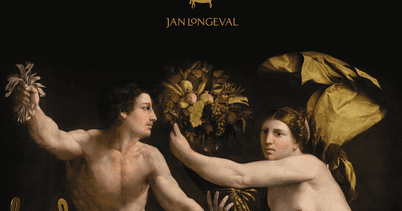

And finally: why did you choose this particular cover?

Jan Longeval replies with a smile: “I’m glad you ask. It is a painting from the Italian Renaissance – the 16th century – that is simply loaded with symbolism. The woman is Lady Fortune, the Roman goddess of good luck, misfortune and fate. She is surrounded by elements that also apply to the stock market: the soap bubble on which she is sitting, calamity (she is wearing only one shoe), prosperity illustrated by a cornucopia, volatility shown by the way her robe flutters, opportunities symbolised by the lottery tickets in the man’s hand, and so forth. But what I like best is the story behind the painting itself. An anonymous buyer bought it for less than 1,000 dollars at a flea market. He tied it to the luggage rack of his car and took it to Christie’s auction house in New York. He got a professional estimate of the value of the work and then sold it to the J. Paul Getty Museum for four million dollars. A perfect illustration of the theme of the painting. And the theme of this book.”

You can buy the book God dobbelt niet op de beurs for € 23.50 with an introductory discount of € 5.00 on the retail price. How?

1/ Send an email to jan.longeval@kounselor.be to obtain a discount code.

2/ Order the book (in Dutch) at Skribis.

- Place the book in your shopping cart

- Go to the cash register

- Fill in all your details (account holders who are logged in can skip this step)

- Select your payment method and enter the discount code in the relevant box

- Place your order

The French translation of the book will be released at the end of May. It is highly likely that this will be followed by an English version.

Prefer an e-book? E-books can also be ordered via www.skribis.be.