#1

in Open Executive Education in Belgium and #25 worldwide

444

Alumni

4.5/5

for Learning Impact

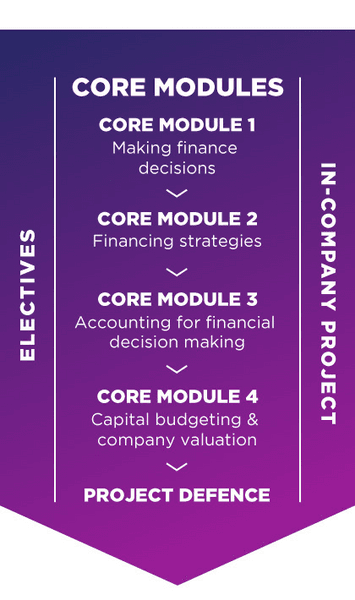

The role of finance is becoming increasingly complex and dynamic. Over the course of one year, the 21-day Executive Master Class in Corporate Finance will give you academic knowledge to underpin your financial expertise. You’ll live and learn analysis, solving complex financial issues. You’ll deepen your knowledge by choosing elective subjects. Then you’ll make the leap and apply everything you’ve learned to a challenge or opportunity in your own organisation.

Detailed programme

Build your knowledge and understanding in two broad phases. In the first, you dive deep into the fundamentals of corporate finance. Across four core modules, you learn how to make finance decisions, you develop finance strategies and work on capital budgeting and company valuation.

You get to live everything you learn in a business opportunity or challenge in your own organisation.

Then in the second phase, you deepen your knowledge by choosing electives that best align with the needs of your company and your role. Choose, for example, the Mergers & Acquisition Path, to enhance your understanding of Creating Value through M&A and Venture Capital and Private Equity. Or follow the Leadership Path and dive deep into Self-Leadership and The People Manager. If you’d rather build your own path, we’d be happy to help you select your electives.

The Executive Master Class in Corporate Finance comprises the following modules:

Module 1: Making financial decisions

- Learn to interpret financial statements and reports to evaluate a firm’s financial performance and risk

- Know how to assess the cash conversion cycle to develop performance optimisation strategies

- Understand financial planning and capital budgeting concepts

- Estimate a firm’s free cash flows

- Learn to critically analyse the financial press

- Take part in the Working Capital Management Interactive Simulation Game

Module 2: Financing Strategies – A deeper dive

- Discover how to calculate the current WACC of a firm

- Learn to design the optimal capital structure of a firm

- Understand how smart debt management creates value

- Understand the CAPM model

- Explore leverage – and know how much to borrow, versus raising equity

Module 3: Accounting for Financial decision making

- Develop your financial accounting literacy skills

- Grasp the sociology of accounting

- Understand the difference between historical cost and fair value accounting

- Understand the key principles of accounting for financial instruments

- Explore non-GAAP financial measures, and their potential to mislead

- Discover AI For the Finance Leader – trends and challenges

Module 4: Capital budgeting and valuation

- Apply advanced company valuation methodologies, including Real Option models

- Evaluate, compare, and construct real-life capital budgeting valuation models

- Explore managerial flexibility and making decisions under uncertainty

- Discover sensitivity analysis, crystal ball and Monte Carlo simulations

In-company project

- Tackle any challenge or opportunity in your own organisation – from acquisition through to LBO, MBO, IPO – and anything in between

- Step back and take a strategic view

- Use your fellow participants and expert faculty as a sounding board

- Create value and ROI

Electives: Tailor your learning journey

- Specialise with 4–6 days from our range of electives

- Use electives to tailor your programme

- Start your electives before, during or after the core module

Why this programme

- Gain the theoretical knowledge that underpins corporate finance

- Learn the latest approaches to financial planning, analysis, capital budgeting and valuation

- Master the tools which will help you maximise the enterprise value of your company

- Choose electives that are highly relevant to your organisation’s needs

- Get immediate ROI for your company with your project

- After graduating from this programme, you are entitled to join our alumni network. Visit the Vlerick Alumni website for more information

Want to get a flavour of this programme? Watch the participant testimonials on this video and get a feel for the energy, enthusiasm, the approach to learning, the return on investment for you and your company and why previous participants recommend this programme to you.

Who should attend

- Finance management professionals who want to enhance their corporate finance knowledge

- Executives who are keen to broaden their business expertise and tackle the key questions in corporate finance

- Consultants or company owners who want to deepen their financial knowledge and be equal conversation partners with Private Equity Investors, financial institutions, auditors and analysts

In previous editions, we had the pleasure of welcoming participants from companies like:

Practical info

To apply for this programme, you need to complete four steps:

1. Check your eligibility: Check if you meet the admissions criteria for the programme you want to apply for.

2. Submit your application: Fill out the application form and upload it together with your cv or LinkedIn profile.

3. Take part in an interview: When we receive your application, we’ll get in touch to set up an interview. This will take about an hour and will cover:

- Your professional experience and current challenges

- Your career ambitions

- Why you want to take the programme

- Which electives are right for you (if the programme includes electives)

4. Confirm your registration: If you pass the interview, we’ll send you a registration form. You’ll have two weeks to complete and submit the form to confirm your programme place.

Faculty

Wouter De Maeseneire

Professor of Corporate Finance

Wouter De Maeseneire is passionate about explaining financial management principles by linking finance to business models and strategies.

Mathieu Luypaert

Professor of Corporate Finance

Mathieu Luypaert explains how insights into financial figures and decisions can lead to value creation.

Bruno Colmant

Adjunct Professor of Financial Accounting

Bruno Colmant is a highly experienced senior leader whose deep knowledge has steered Belgium’s largest financial institutions and government.

Peter Maenhout

Investor in Residence

Peter Maenhout is Partner and CEO at M80 Partners – and brings deep investment expertise to his work with Vlerick.

Get in touch!